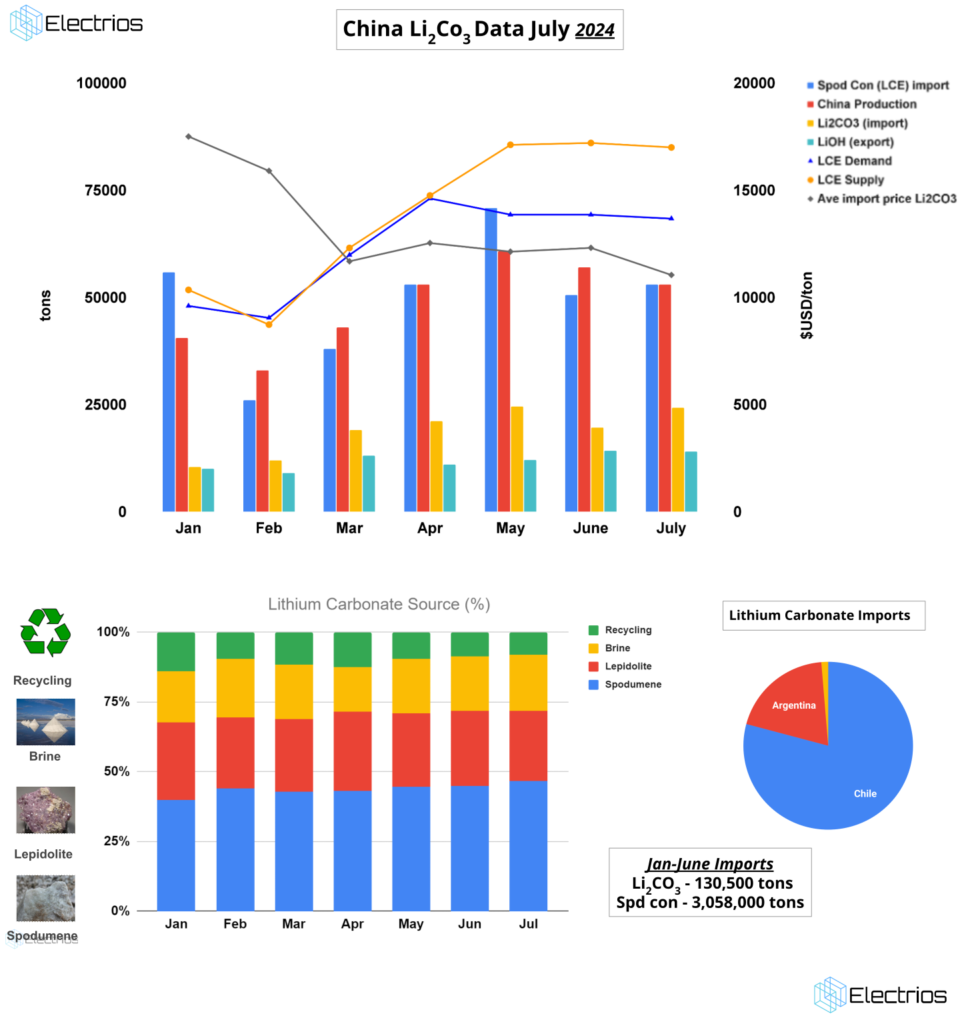

2024 Lithium Carbonate July (China)

The last month saw major developments in the lithium market, setting the stage for a potentially interesting end to the year.

- Production Cuts Gain Momentum: In response to cost pressures, we are witnessing a significant increase in production cuts and suspensions, primarily among high-cost producers.

- Close to the Cost Curve:

- Brine to LCE: Production cost range 4,000 to 8,000 $/ton.

- Spodumene to LCE: Production cost range 6,000 to 10,000$/ton.

- Lepidolite to LCE: Production cost range 8,000 to 12,000 $/ton

- Price Rebound in Sight: After hitting annual lows, lithium carbonate prices have started to show encouraging signs of recovery linked to the production cuts and growing anticipation of increased demand towards the end of the year.

- EV Sales and Battery Production to Accelerate: Expectations are high for a significant ramp-up in EV sales and battery production towards the end of 2024. This anticipated surge in demand further supports the possibility of price improvements in the lithium market.

- LME Lithium Hedging Strategies: As market volatility persists, many lithium companies are actively exploring hedging strategies, such as the LME’s Lithium Hydroxide CIF