2024 Lithium Carbonate Market

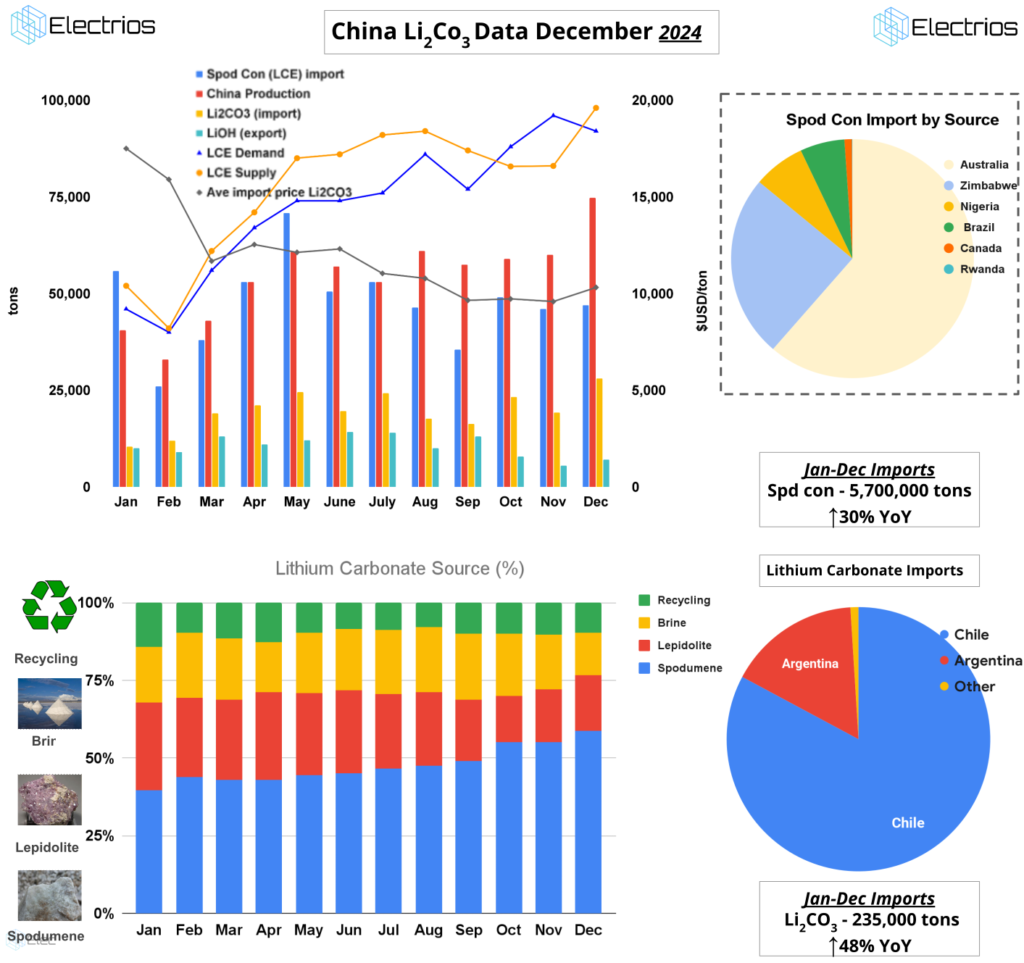

The lithium carbonate market in China was a disappointment to say the least in 2024. Chinese annual production capacity grew to over 1.3 million tons, while capacity utilization remained just over 50% producing 656,600 ton of lithium carbonate, highlighting low demand. Primarily driven by increased spodumene processing capacity resulting in oversupply, low prices and profit warnings Ganfeng and Tianqi Lithium.

The increase in lithium carbonate production was largely attributed to additional Chinese and global spodumene coming online shockingly quick. Contrary to 2023 Lepidolite’s growth slightly stalled due to environmental issues and high production costs in a low price market. Unstable market conditions and price fluctuations led to cautious downstream procurement wait and see strategies Lithium carbonate rode the front row on the big dip roller coaster as prices fell from around 95,000 RMB/ton ($13,100 USD) at the end of 2023 to about 75,000 RMB/ton ($10,350 USD ) by the end of 2024.

This decline pushed producers closer to the production cost, forcing production cuts and shutdowns, especially among those with higher production costs like some African and lepidolite projects

Approx. Lithium carbonate production costs

- Brine :

- Brine lithium extraction is generally the most cost-competitive, with costs ranging from 30,000 to 50,000 RMB/ton.

- Chile-Bolivia-Argentina : have costs less than 50,000 RMB/ton LCE.

- Spodumene:

- High-quality spodumene mining costs are roughly between 40,000 and 60,000 RMB/ton.

- Lepidolite:

- High-quality lepidolite ore has costs of about 60,000 to 80,000 RMB/ton.

- Low-quality lepidolite projects face the highest cost pressure, with cash costs exceeding 120,000 yuan/ton.

- African Resources:

- African lithium resources have relatively high costs, ranging from 70,000 to 110,000 RMB/ton, mainly due to high energy and transportation costs. However, some African mines have costs in the range of 60,000-65,000 RMB/ton.

- Brazilian Resources:

- Brazilian lithium mines have costs in the range of 50,000-60,000 RMB/ton.

- Cost Reduction:

- Companies have been focused on cost control, optimizing mining and selection costs, improving yields through technical innovation, and streamlining equipment.

- Chinese companies in Africa and South America have focused on optimizing costs related to logistics, electricity, and exchange rates.

Electrios Outlook for 2025

2025 is poised to be a year of transition for the lithium carbonate market. While oversupply is likely to persist, we expect the market to gradually improve, with prices stabilizing and the market moving towards a better balance between supply and demand.

- Prices: Expect ongoing volatility, with prices likely ranging between 60,000 and 100,000 RMB/ton. A potential supply shortage in the second half of the year could push prices upward. Though it is unlikely prices will return to the highs of 2022.

- Supply: Chinese production is estimated to reach 800,000 tons of LCE, supplemented by 300,000 tons of imports. Lingering high inventory levels from 2024 will continue to be a key factor in the lithium carbonate market in early 2025.

- Demand: Global demand is projected to grow at slower rate of at least 28%, in this scenario, supply/demand mismatch will continue.